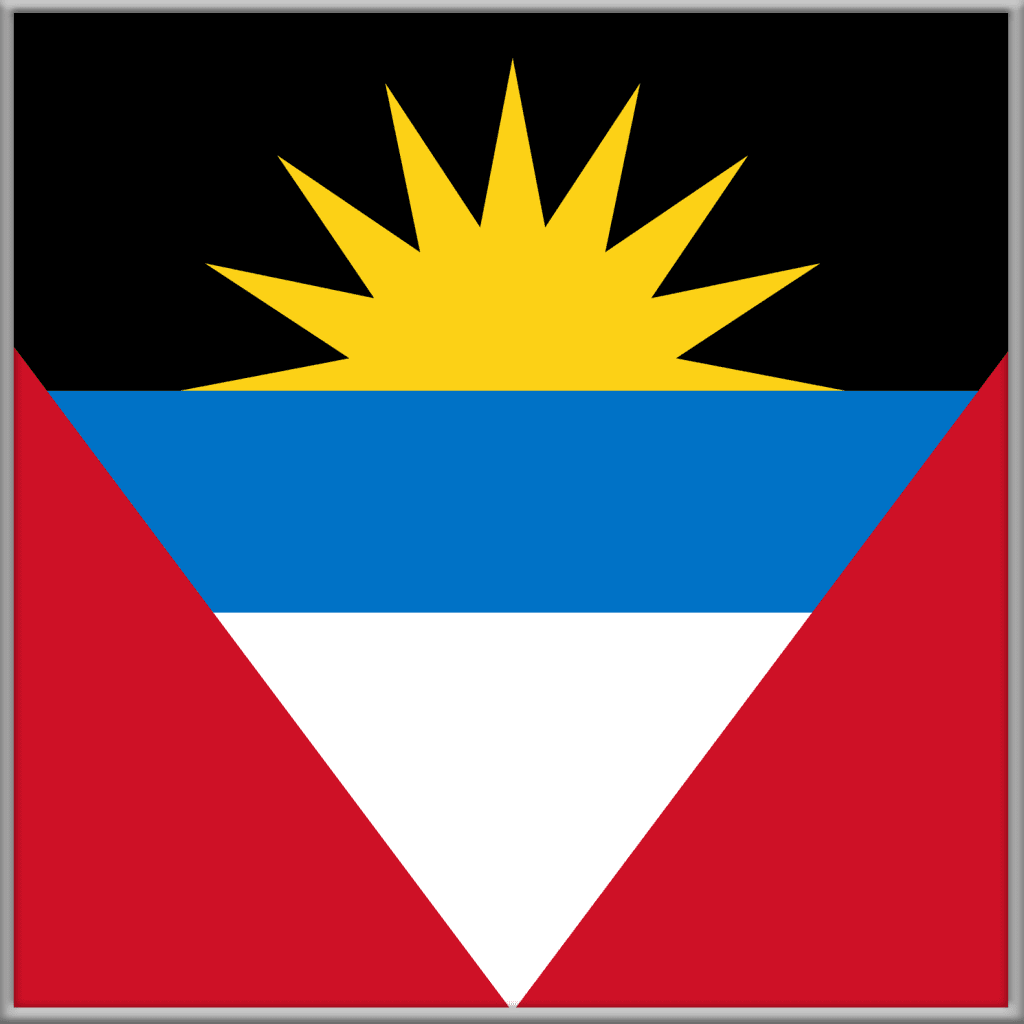

Antigua and Barbuda

Antigua and Barbuda

Antigua and Barbuda is an independent country in the Lesser Antilles, in the eastern Caribbean Sea. It is made up of two main islands, Antigua and Barbuda, as well as a number of smaller islands. Antigua and Barbuda is a popular tourist destination, known for its beautiful beaches, its clear blue waters, and its many resorts.

Pros: Using Antigua and Barbuda as an Offshore Jurisdiction:

Political stability: Antigua and Barbuda is a stable democracy with a strong rule of law. This makes it a safe and secure place to do business.

Strong financial system: Antigua and Barbuda has a strong financial system with a well-developed infrastructure. This makes it easy to set up and operate a business in Antigua and Barbuda.

Favourable tax laws: Antigua and Barbuda has a favourable tax regime for businesses. There is no corporate income tax, no capital gains tax, and no withholding tax on dividends.

Privacy: Antigua and Barbuda has a reputation for financial privacy and confidentiality. This is due, in part, to the fact that Antigua and Barbuda does not have any exchange of information agreements with other countries. This means that the Antiguan and Barbudan government is not required to share information about Antiguan and Barbudan companies or accounts with other governments.

Visa-free travel: Citizens of many countries, including the United States, Canada, and the United Kingdom, can travel to Antigua and Barbuda without a visa. This makes it easy for business owners to travel to and from the country.

Considerations: Using Monaco as an Offshore Jurisdiction:

Cost: Antigua and Barbuda is a relatively expensive place to live and do business.

Regulation: The Antiguan and Barbudan government is increasingly cracking down on offshore businesses. This could make it more difficult to set up and operate a business in Antigua and Barbuda in the future.

Reputation: Antigua and Barbuda has a reputation as a tax haven. This could make it difficult to attract customers and investors.

Overall, Antigua and Barbuda is a good option for businesses that are looking for a stable, secure, and tax-efficient offshore business location. However, businesses should be aware of the costs, regulations, and reputation of Antigua and Barbuda before making a decision.

Antigua and Barbuda, serving as an offshore jurisdiction, presents appealing features such as a tax-friendly environment with the absence of personal income tax and an enticing Citizenship by Investment program for foreign investors. These advantages have attracted individuals and businesses seeking financial opportunities in the region. Nevertheless, the jurisdiction does confront challenges related to transparency and regulatory compliance. Recent efforts have been made to strengthen its regulatory framework and align with international standards. As such, Antigua and Barbuda remain an attractive choice for offshore activities, but prudent stakeholders should remain vigilant and stay informed about evolving regulations and compliance requirements.

SearchOffshore.com – The Leading Offshore Professional Services Directory

SearchOffshore.com is the leading online directory for offshore professional services, connecting businesses with top-tier providers in finance, legal, consultancy, and corporate services worldwide. Our platform helps companies find trusted offshore experts while enhancing visibility for service providers. Whether you specialise in offshore banking, company formation, tax advisory, or asset protection, SearchOffshore.com ensures your business stands out. Discover the best offshore solutions and expand your global reach today.