Bahamas

Bahamas

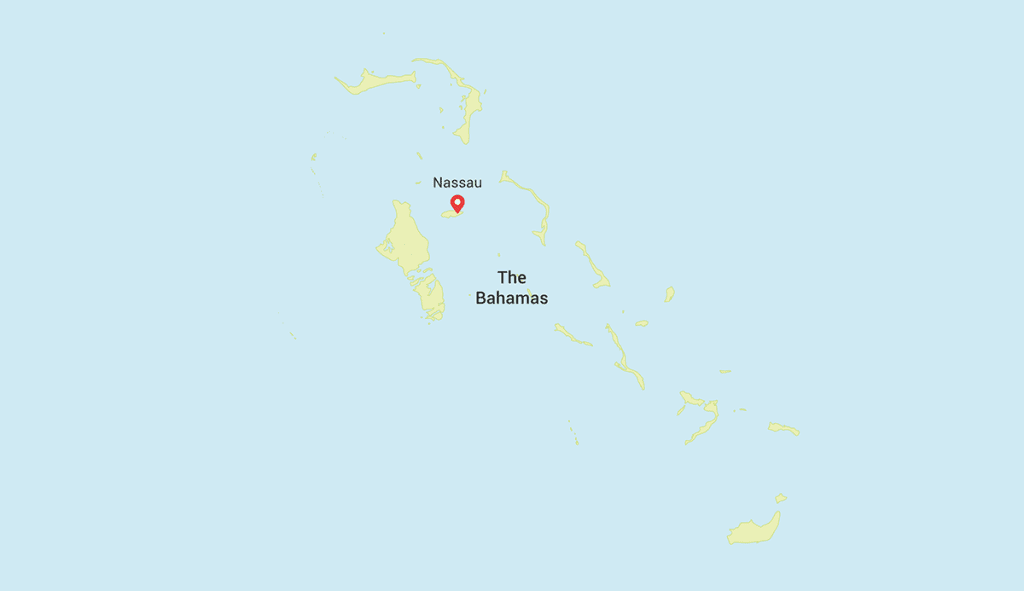

The Bahamas is an archipelago of over 700 islands and islets in the western Atlantic Ocean. It is located about 50 miles off the coast of Florida. The capital of the Bahamas is Nassau, which is located on New Providence Island. The Bahamas is a popular tourist destination, known for its beautiful beaches, its clear blue waters, and its friendly people. It is a popular offshore business location due to its political stability, strong financial system, and favourable tax laws.

Pros: Using the Bahamas as an Offshore Jurisdiction:

Political stability: The Bahamas is a stable democracy with a strong rule of law. This makes it a safe and secure place to do business.

Strong financial system: The Bahamas has a strong financial system with a well-developed infrastructure. This makes it easy to set up and operate a business in the Bahamas.

Favourable tax laws: The Bahamas has a favourable tax regime for businesses. There is no corporate income tax, no capital gains tax, and no withholding tax on dividends.

Privacy: The Bahamas has a reputation for financial privacy and confidentiality. This is due, in part, to the fact that the Bahamas does not have any exchange of information agreements with other countries. This means that the Bahamian government is not required to share information about Bahamian companies or accounts with other governments.

Visa-free travel: Citizens of many countries, including the United States, Canada, and the United Kingdom, can travel to the Bahamas without a visa. This makes it easy for business owners to travel to and from the country.

No exchange controls: The Bahamas has no exchange controls. This means that businesses can freely move money in and out of the country.

Considerations: Using Anguilla as an Offshore Jurisdiction:

Cost: The Bahamas is a relatively expensive place to live and do business.

Regulation: The Bahamian government is increasingly cracking down on offshore businesses. This could make it more difficult to set up and operate a business in the Bahamas in the future.

Reputation: The Bahamas has a reputation as a tax haven. This could make it difficult to attract customers and investors.

Overall, the Bahamas is a good option for businesses that are looking for a stable, secure, and tax-efficient offshore business location. However, businesses should be aware of the costs, regulations, and reputation of the Bahamas before making a decision.

Bermuda has carved out a prominent niche as a leading offshore financial center. Its reputation for stability, transparency, and a tax-efficient environment has made it an attractive destination for international businesses and investors seeking to optimize their financial strategies.

Political Stability: Bermuda is renowned for its political stability and adherence to the rule of law. Its British Overseas Territory status provides a stable and well-regulated environment that instills confidence among businesses and investors.

Tax-Neutral Environment: One of Bermuda’s key attractions is its tax-neutral status. The jurisdiction imposes no corporate income tax, capital gains tax, or value-added tax, making it highly favorable for those looking to reduce their tax burdens legally.

Asset Protection: Bermuda offers robust asset protection measures, ensuring the safeguarding of wealth and assets. Trust structures, insurance products, and other legal mechanisms make it a reliable choice for asset preservation.

Confidentiality: The island respects client confidentiality and privacy, with strict regulations in place to protect sensitive financial information.

Legal Framework: Bermuda boasts a well-established and mature legal system, with a strong emphasis on contract enforcement, intellectual property protection, and dispute resolution.

Global Connectivity: Bermuda’s strategic location and excellent connectivity make it an ideal base for international operations. It serves as a gateway between North America and Europe, facilitating trade and business relationships.

Financial Services Expertise: Bermuda has a thriving financial services sector, with a deep pool of expertise in insurance, reinsurance, asset management, and wealth management.

In summary, Bermuda’s appeal as an offshore destination lies in its political stability, tax advantages, asset protection capabilities, and commitment to confidentiality. Its well-developed legal framework and strategic location further solidify its position as a trusted and competitive choice for international businesses and individuals looking to optimize their financial and investment strategies.

Bermuda is a popular tourist destination, known for its pink-sand beaches, its clear blue waters, and its many golf courses. The island is also home to a number of historical sites, including the Royal Naval Dockyard, which was once a British naval base. Bermuda is a member of the Commonwealth of Nations and the United Nations.

SearchOffshore.com – The Leading Offshore Professional Services Directory

SearchOffshore.com is the leading online directory for offshore professional services, connecting businesses with top-tier providers in finance, legal, consultancy, and corporate services worldwide. Our platform helps companies find trusted offshore experts while enhancing visibility for service providers. Whether you specialise in offshore banking, company formation, tax advisory, or asset protection, SearchOffshore.com ensures your business stands out. Discover the best offshore solutions and expand your global reach today.