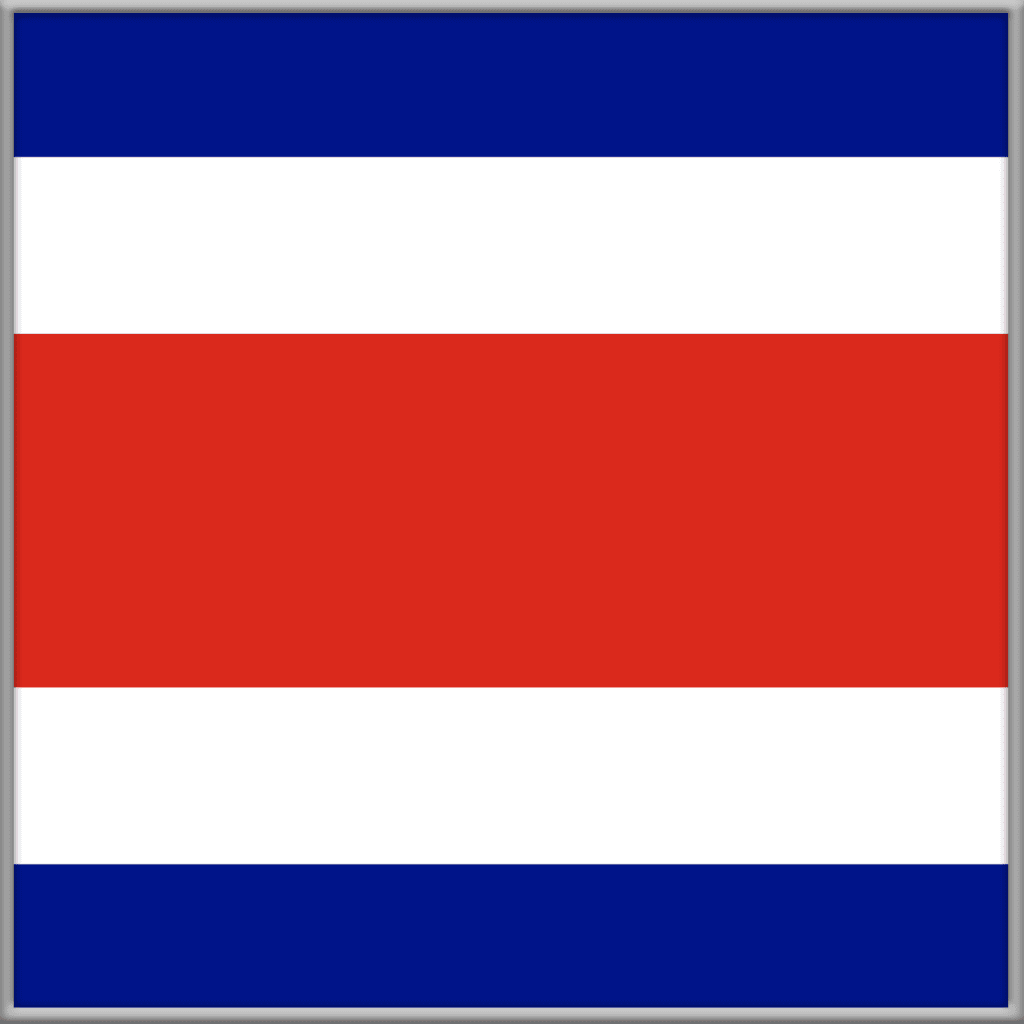

Costa Rica

Costa Rica

Costa Rica, nestled in Central America, is emerging as a promising offshore jurisdiction for individuals and businesses seeking favorable tax conditions and asset protection. Known for its stable political environment, skilled workforce, and breathtaking natural beauty, Costa Rica offers a unique blend of offshore advantages and a high quality of life. With favorable tax regulations, robust asset protection laws, and a commitment to transparency, it presents an appealing option for those looking to optimize their financial strategies while enjoying the country’s natural splendors.

Pros: Using Costa Rica as an Offshore Jurisdiction:

Stable Political Environment: Costa Rica is known for its political stability, democratic governance, and respect for the rule of law, providing a secure environment for offshore activities.

Tax Benefits: The jurisdiction offers favorable tax conditions, including no capital gains tax on offshore income, making it attractive for tax planning and wealth management.

Asset Protection: Costa Rica has strong asset protection laws and regulations, providing effective mechanisms to safeguard assets from legal disputes and creditors.

Skilled Workforce: The country boasts a well-educated and bilingual workforce, which can be beneficial for businesses requiring specialized skills and services.

Natural Beauty: Beyond its offshore appeal, Costa Rica’s natural beauty and tourism industry make it an attractive destination for those seeking a high quality of life.

Considerations: Using Costa Rica as an Offshore Jurisdiction:

Limited Treaty Network: Costa Rica has a relatively small network of double taxation treaties, potentially limiting international tax planning options.

Regulatory Changes: As with many offshore jurisdictions, Costa Rica has implemented regulatory changes to enhance transparency and compliance, which may impact business practices.

Operational Costs: The overall cost of doing business, including operational expenses, can be relatively high compared to some other offshore destinations.

Distance from Major Financial Centers: The geographical distance from major financial centers can result in logistical challenges and increased communication costs.

Banking Constraints: Access to banking services for offshore entities in Costa Rica can be limited, necessitating international banking relationships that may involve additional complexities.

In summary, Costa Rica offers a stable political environment, tax benefits, asset protection, and a skilled workforce for offshore activities. However, businesses and individuals should carefully evaluate factors like the treaty network, regulatory changes, operational costs, distance from financial centers, and banking constraints when considering it as an offshore jurisdiction.

SearchOffshore.com – The Leading Offshore Professional Services Directory

SearchOffshore.com is the leading online directory for offshore professional services, connecting businesses with top-tier providers in finance, legal, consultancy, and corporate services worldwide. Our platform helps companies find trusted offshore experts while enhancing visibility for service providers. Whether you specialise in offshore banking, company formation, tax advisory, or asset protection, SearchOffshore.com ensures your business stands out. Discover the best offshore solutions and expand your global reach today.